Home > Student Loan

Student Loan

Achieve Your Dreams with SLTC Student Loan

SLTC and HNB partner to empower students with tailored financing, flexible repayment, and dedicated support – making higher education more accessible and stress-free.

Loan Features

High Loan Coverage

Loans ranging from Rs. 100,000 up to Rs. 20Mn to support your educational journey.

Bank Funded Education

The bank will fund up to 90% of your total course fees directly to the institution.

12 Years Extended Repayment

Flexible repayment terms extending up to 12 years. A) 4½ Years Interest only(I Study-"Parents pay") B) 7½ Years Capital+Interest ( I Work- "I Pay")

Student-Friendly Payment Structure

Customize your loan repayments during your degree period by choosing to pay only the interest or setting up alternative payment terms.

Competitive Interest Rates

Benefit from our lowest rate of interest.

Hassle-Free Semester Payments

Bank directly manages your semester payments for a smooth academic journey.

Special Discount to Loan Students offered by SLTC

50,000 Special Discounts for Loan Students offered by SLTC as a Funding Support

How to Pay SLTC Fees with A Bank Loan

Example: Say your Degree Price is Rs. 1.2M

How it works? If My Degree Price is 1.2 Mn (Rs. 1,200,000)

1 Pay the Down-Payment

Firstly, make the down payment of Rs. 50,000 and secure your price with early bird discounts

2 Secure SLTC Special Discount of Rs. 50,000

This is offered only for loan students, inform your intention to obtain the loan

3 Know your Net Price After Down-Payment and Discount

Rs. 1,200,000-50,000-50,000) = Rs. 1,100,000

4 Bank will Take Care of all your fees; semester wise

(1,100,000/8) = 137,500 Based on the Above Net Price (Funded by the Bank)

How to Benefit From 90% Bank Funded Education

- Out of Rs. 1,200,000 Course price, Bank will Fund 90% (Rs. 1,080,000).

Student needs to Pay Only 10% (Rs. 120,000).

How to Fund My 10%

Example – Rs.120,000 (120K) is completed as follows

1 Initial Down-Payment of Rs.50,000.

2 SLTC Offers a Special Discount of Rs. 50,000 as a support

3 Only the Balance Amount of Rs. 20,000 Should be Deposited to the bank to get the loan (120K=50K+50K+20K)

4 Students Always have the Option to Increase their Bank Deposit to Reduce their Loan Amount

E.g. Deposit Rs.150,000 Instead of Rs.20,000, can Reduce the Loan Amount to Rs.950,000 Instead of Rs.1,080,000

Student Payments to the Bank

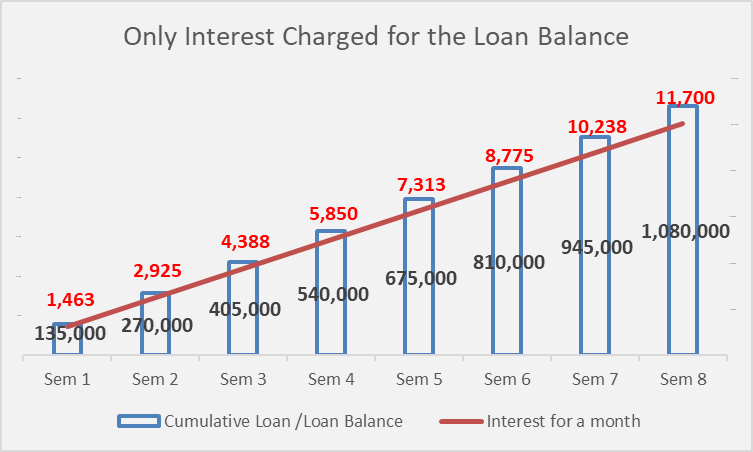

Assume You Take a Loan of Rs.1,080,000 as per the Example Above

I Study - Parents pay

Pay Low to Study

Important Note:

“From the very first month, just deposit Rs.11,700 into your savings account. The bank will only deduct the interest portion of your loan (example: Rs.1,463 during the first semester), and the rest ‘stays in your Bank Account.’ Example- Rs.10,237 (11,700-1,463) is yours to use as you wish until the 8th semester!”

A) Low Re-payments during the Degree Period

1 Monthly Interest Charged only for the loan balance

Interest starts as low as just Rs.1,463/month during your first semester. {(135,000×1)x(example rate 13%/12)}

2 Maximum Interest is only Rs 11,700/month even at the 8th Semester

By the time you finish your degree, the maximum interest you’ll pay is Rs. 11,700. {(135,000×8)x(13%/12)}

3 Flexible Repayment Options

You can choose to pay just the interest during your studies and for extra 6 months after – that’s 4 ½ years of interest-only payments!

Disclaimer: Repayment values will change based on market interest rates (above rate is only an example) and the amount of loans obtained from the bank

I Work - I Pay

Re-Pay with Salary

B) Re-pay while you earn based on your salary

1 7 1⁄2 Years to repay

Earn your degree, start work, then it’s time to start repaying your loan.

2 90 Monthly Installments

90 Monthly Installments

3 Loan Paid Off

With diligent monthly payments, you’ll have the loan fully repaid in 7 1⁄2 years.

Disclaimer: Repayment values will change based on market interest rates (above rate is only an example) and the amount of loans obtained from the bank

Loan Eligibility Requirements

-

For Loans Under

Rs. 1 MillionParent or sponsor must demonstrate a minimum gross monthly salary of Rs. 75,000

-

For Loans Above

Rs. 1 MillionParent or sponsor must demonstrate a minimum gross monthly salary of Rs. 100,000

-

Alternative Option

If seeking a loan above Rs. 1 million without meeting 100,000 salary requirements, provide property documentation as collateral

-

For Loans Under

Rs. 1 MillionParent or sponsor must demonstrate a minimum gross monthly salary of Rs. 75,000

-

For Loans Above

Rs. 1 MillionParent or sponsor must demonstrate a minimum gross monthly salary of Rs. 100,000

-

Alternative Option

If seeking a loan above Rs. 1 million without meeting 100,000 salary requirements, provide property documentation as collateral

We're Here to Help You

Our dedicated team of loan specialists is ready to guide you through the student loan process. Reach out to our Banking partner through any of these channels:

Email Support

Send us your inquiries with Contact Numbers to call back

priyantha.ruwanpathirana@hnb.lk

shakya.hewaangappulige@hnb.lk

Personal Assistance

Contact HNB loan specialists directly:

- Chinthana: 0112 830 040

- Suranga: 077 365 0066

- Priyantha: 077 725 0366

- Shakya: 077 062 9364

Thank You for Choosing

SLTC-HNB Student Loans

We’re honored to support your educational journey and help you achieve your goals. Our team is dedicated to providing a seamless student loan experience from start to finish.